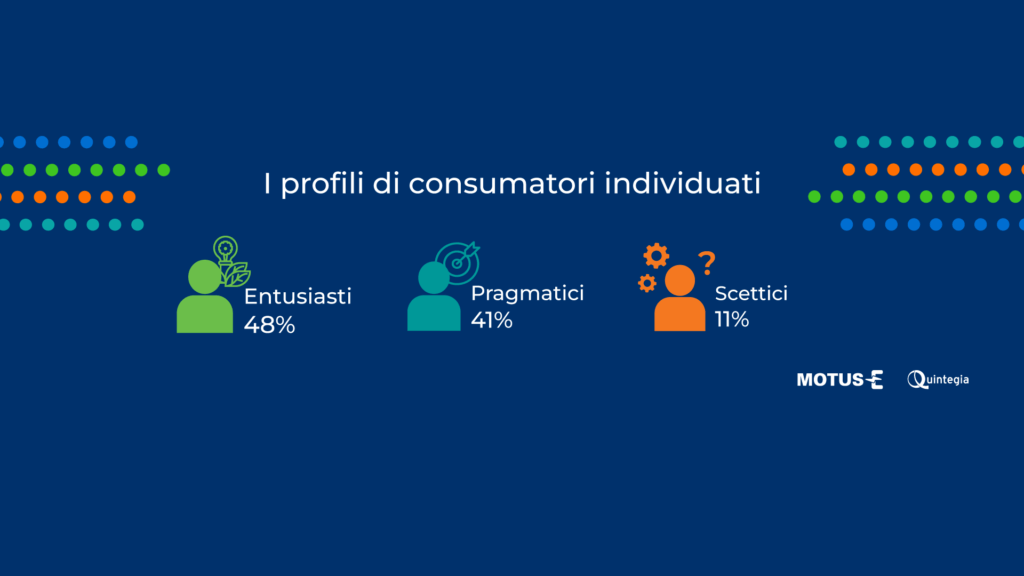

In the two previous articles, taken from the study “Electric Mobility: Inevitable or Not? Analysis from the Consumer Perspective” conducted by Quintegia and Motus-E, we delved into how the purchase price of BEVs and the battery and charging access influence purchase choices. But when studying the sample of respondents, how can various consumers be classified?

According to what emerges from the study, it is possible to identify 6 different segments of buyers grouped into 3 categories (Enthusiasts, Pragmatists, Skeptics). This classification was obtained by observing the purchasing behavior of respondents by projecting them into ‘hypothetical showrooms’ of new cars. Each segment of consumers assigns different value to individual characteristics, so they make different choices when faced with the same offer. The division was based on attributes such as income, age, gender, average annual mileage, experience with electric cars, and attitudes towards environmental issues, car usage, electric vehicles, new car models, and technology in general.

The first category is represented by Enthusiasts: they can be divided into Innovators and Wealthy Pioneers. Both groups of consumers, when purchasing their current cars, considered BEVs as a possible choice.

Innovators have considerable financial resources, and the majority of them are men. They use their cars infrequently and are not sensitive to new technological releases, but they support the electrification of cars because they perceive environmental issues significantly.

Wealthy Pioneers, on the other hand, are younger with high incomes, and most of them use their cars for daily work commutes. They are also sensitive to environmental issues, although they are not particularly enthusiastic about electric vehicles. They are very interested in next-generation models.

In the second category, we have Pragmatists. These respondents have a significant inclination towards environmental conservation, and their purchasing behavior reflects this. They can be divided into Environmentalists and Moderate Environmentalists. Both groups have seriously considered purchasing an electric car.

Environmentalists have a substantial income and drive many kilometers per year. They are attentive to technological innovation and environmental conservation, although they have not yet formed a clear opinion on vehicle electrification.

Moderate Environmentalists differ in that the majority of them are unemployed women with low incomes. Compared to others, they are less attracted to technological novelties.

The third and final category is occupied by Skeptics, which includes the Disinterested and the Unfulfilled. This group, with a significant concentration of women, shares skepticism towards electric cars, although for completely different reasons.

The Disinterested are not particularly concerned about environmental issues. They have average incomes, and a significant portion of these consumers is retired.

The Unfulfilled, on the other hand, are younger with good employment but lower incomes. They are concerned about environmental issues and support electric cars, although the high price makes them choose other fuel options.

In summary, the demand for electric cars is driven by the Enthusiasts segment, especially the Innovators. The Pragmatists, led by Environmentalists and then Moderate Environmentalists, will follow when the purchase price decreases, driven by a strong environmental awareness. The behavior of Skeptics will differ in the coming years, with the Disinterested leaning towards BEVs in 2030 and the Unfulfilled waiting for a real price drop before choosing electric cars.

To draw conclusions from the three in-depth articles published so far, we can summarize the results of the entire study into 4 key messages:

1. The transition to electric is inevitable.

Consumers expect that electric cars will become the most demanded by consumers starting from 2025. This increased demand depends on the gradual reduction in the purchase price of BEVs compared to current ones. It is predicted that the break-even point between different fuel types will occur by 2030 for lower-end car models.

2. Consumers do not consider synthetic fuels a convincing alternative to electric cars.

In the best-case scenario, in 2030, the total cost of ownership (TCO) of traditional cars powered by synthetic fuels will be 23% higher than that of electric cars. Also, the operating costs of cars fueled by e-fuels will be higher, so consumers will be inclined to choose BEVs. Moreover, apart from being less economically viable, synthetic fuels are characterized by a lower environmental resource efficiency.

3. Public charging infrastructure does not limit the demand for electric cars.

The public charging network alone does not significantly influence the demand for electric cars. Additionally, consumers without access to home charging are, on average, 12% less likely to purchase an electric car, but this is not a major issue because 89% of consumers have private parking or a non-street parking space where they can potentially charge their cars. However, it is clear that not having access to either private or public charging points would be a significant barrier to electric car adoption, and public charging infrastructure should keep pace with the increasing market share of battery electric vehicles.

4. Today, under equal conditions, electric cars are consumers’ preferred choice.

Most consumers would choose an electric car as their first option if all conditions were equal. *

*(Conditions being purchase price, operating costs, unlimited access to charging points, and a fully electric range of 80 km for PHEVs and 500 km for BEVs).