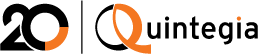

Quintegia presented at Service Day the first edition of the study “After-sales Navigator: Present and Future of After-sales for Dealer,” which explores in detail the growing importance of after-sales for automotive dealer in order to provide them with a detailed picture of the most relevant opportunities and issues.

The study looks at the key pieces of after-sales for dealers: business extension, customer experience and organization. Already 29% of dealers surveyed are overseeing these in a structured way across all the different facets, indicating that the issues are being attended to and with actionable potential for many players.

An analysis of the turnover derived from after-sales shows that on average more than 70 percent comes from maintenance work and the sale of spare parts. This figure indicates to us that dealers are still very focused on the more traditional after-sales business, while high-potential areas such as bodywork, accessories and services are still partly or poorly developed.

With a view to future evolution and increased after-sales business, most dealers will focus on people (66 percent) and process optimization (49 percent); while to a lesser extent they consider customer experience services (19 percent), facilities (16 percent) and brand portfolio expansion (6 percent) to be relevant. According to 67% of dealers, the transition to electric will significantly affect after-sales strategies . Le aree sulle quali si farà più affidamento per compensarne l’impatto sono: carrozzeria, pneumatici e servizi.

“The analysis, which is a concrete tool that can accompany those who do business in the service industry, stems from the consideration that after-sales service is not just an operational area, but a strategic element for marginality and customer loyalty. Through the in-depth study of the current dynamics of this industry, a picture is crystallized that, while on the one hand indicates a conservative approach that does not facilitate growth, on the other hand highlights areas of intervention that propose a number of opportunities and the willingness of the protagonists to consider new avenues,” says Alberto Bet of Quintegia.

BUSINESS EXTENSION

For 63 percent of dealers, the bodyshop represents an area in which they can seize opportunities: because the marginality is attractive and offering an all-round service helps maintain the bond of trust with the customer. A brake on the development of the bodyshop business is mainly competition and, in some cases, lack of resources, understood as facilities, people and capital. If the tire-related area is examined, the low margin level requires high sales volumes to make the business profitable.

CUSTOMER EXPERIENCE

In terms of customer experience, the most consistently manned aspect concerns on-site services, with 64 percent of dealers offering an executive waiting room and additional mobility services. Only 19 percent, on the other hand, offer a structured online experience, providing the ability to book interventions, mobility services and a live update on the work status of their vehicle. In terms of how service is accessed, 17 percent provide all of these: fast-lane, pick-up and delivery, and home service.

ORGANIZATION

Organization includes all aspects that affect the systems, people, and management processes within the after-market. Here the study focused on some of the currently most relevant implications. In particular, turnover, which is confirmed as a hot topic since just 33% indicate a very low level of it with figures such as mechanic and service acceptor among the most difficult to find and/or replace; communication is also an area in which there is ample room for improvement for 87% of dealers. In addition, 21 percent of dealers are already experimenting with the use of AI, and more than half (52 percent) of those who do not yet have it would like to introduce it in order to seize its opportunities in terms of streamlining internal processes. Opportunities that also affect the topic of reconditioning used equipment, and particularly for those who are intent on setting up a specialized location for this activity (today 17 percent have one).

This is an analysis that, for the first time, draws a complete picture of after-sales, its evolution and opportunities for expanding the range of services offered. The objective of the Study was to gather the views of dealers and share them, to offer useful stimuli for defining future strategic trajectories of after-sales in such a complex and articulated historical period for the industry.

Download the free excerpt or purchase the full study at this LINK