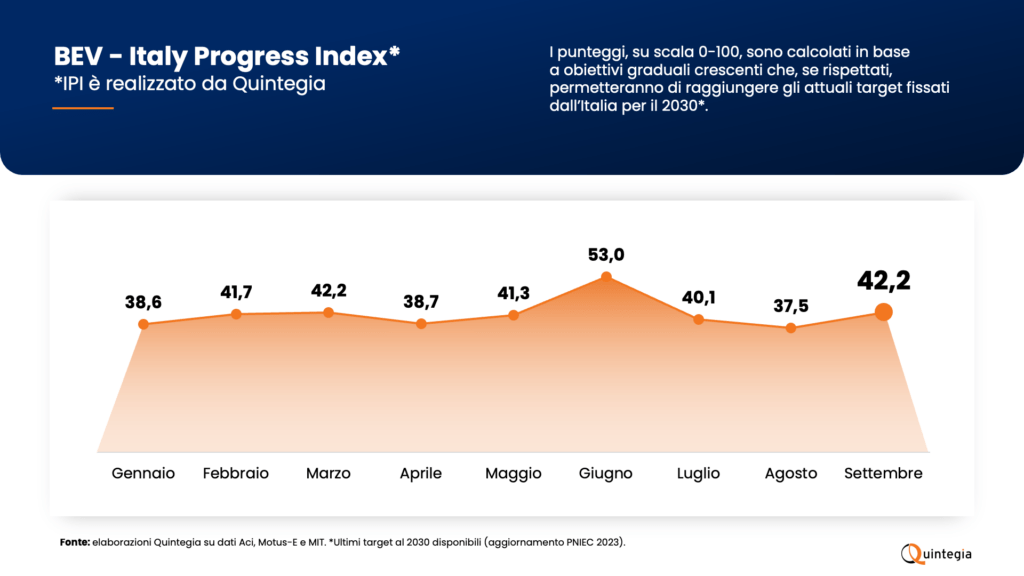

In the first 9 months of 2024, the electrification process in Italy has progressed hiccupily, with slowdowns and results far from expectations. This is the picture provided by Quintegia’s Italy Progress Index*, which – by systemizing the trends in charging infrastructures, registrations and the electric vehicle fleet – describes a complex situation that has not been smooth and growing. Translated into numbers: 42.2 points out of 100 in September 2024.

Among the three components considered in calculating the Index-the BEV fleet, BEV registrations and electric charging infrastructure – the only positive figure is the steady growth in infrastructure. The spatial analysis shows how the data range fluctuates from 71.2 points out of 100 for the South and Islands to 90.2 points for the Northwest.

In contrast, the BEV fleet score is declining, with a trend that has brought levels back below those of January 2024. As for registrations, after a steadily declining trend, with the exception of June, there was a slight recovery in September. However, the results achieved represent less than a quarter of what is needed to achieve the targets set.

“The index is a tool that can measure how and how fast our country is approaching the goal set for 2030 (which calls for 6.6 million BEV and PLUGIN electric vehicles on the road – source PNIEC).

The analysis of the first 9 months of 2024 describes a path with the handbrake pulled. It is difficult to determine the causes of such a result and complex to understand whether Italy does not want electrification, is not ready or there are endemic causes. The only certainty is that in order to achieve its goals, the country should significantly accelerate the speed of growth in the use of electric cars and increase the presence of charging points.” states Nicola Pasqualin Senior Researcher & EV Expert, E-commerce at Quintegia.

Registrations

In the first 9 months of 2024, BEV registrations totaled just under 48,500, up only 5.3% and with a firm market share of 4.0% (+0.1 p.p. vs. 2023). There was a peak only in June, due to the presence of purchase incentives. This situation is much lower than the EU average of 12.6 percent and also down from 2023 (-1.3 p.p.) [Source: Acea].

Circulating fleet

The vehicle fleet replicates what happened with registrations: a steady decline albeit at a slower rate. Compared to the same period in 2023, there is a 6-point decline, leading to a result of 31.4 per 100. A halt in the decline occurred, again, in June, and then instead gave way in July and August to a decrease. Currently, the BEV fleet has about 262,000 units.

Charging infrastructure

Continued steady growth in charging infrastructure, although the speed of installation has decreased slightly because the vehicle fleet remains minimal and undersized compared to the already installed charging network. Geographically, the Northwest scored the highest. In total on the Peninsula, according to the latest update in June 2024, there are just under 57,000 charging points, of which 18.55 percent are direct current (DC) [Source: Motus-E].

*The index is a quantitative analysis and considers three components:

- the BEV fleet**

- quarterly BEV registrations**.

- electric charging infrastructure, the latter evaluated by both diffusion and power delivery**

**Quintegia elaborations on ACI, Motus-E and MIT data.