Editorial by Leonardo Buzzavo

Volatility. Recent events have brutally highlighted the astonishing volatility of our times. Apart from the strong impact on all of us as citizens, there is a growing impact on the economic fabric and companies, which obviously includes the automotive sector, including distribution and services operators. From images of areas in China facing difficulties, perceived as very distant, with some fairly limited repercussions on logistics chains, we have quickly transitioned to situations such as the cancellation of benchmark events (e.g., the Geneva Motor Show), the subsequent restriction of non-essential travel, and the closure of dealerships and factories, not only in Italy but also in many other countries. For dealerships, this represents a double blow, affecting both disposable income and trust (factors that have always led to a contraction in car sales) and mobility itself, which is the core of those who sell and service vehicles and the connected service industry.

Immediate Consequences. The outbreak of the Covid-19 emergency has led to a series of immediate challenges, such as logistical issues related to office closures (while partially maintaining the possibility of providing some service assistance), decisions regarding working methods and personnel (telecommuting, smart working, vacations, and temporary layoffs), the use of digital tools wherever possible (e.g., interacting with customers, presenting novelties), and managing financial stress. There is no doubt that this is generating a very – though unwanted – intense digital workout, both in terms of working methods and retail processes.

For companies like dealerships, such a sharp decline in revenue compared to a strong cost rigidity (real estate, personnel, equipment) represents an unprecedented challenge. A recent study conducted by Cerved assesses the impact of the crisis on the Italian economy, examining various sectors and considering two options: a base scenario in which the emergency lasts until May 2020 with two months required for a return to normalcy; a pessimistic scenario in which the emergency lasts until December 2020 with six months required for a return to normalcy. In the first case, the expected revenue contraction for car dealers in 2020 compared to 2019 is 24.5%, while in the second case, it reaches 55%. Given the way events are unfolding, there is a certain probability of the pessimistic scenario, without excluding an even worse one. This impact undoubtedly exceeds that generated by previous crises, including the global financial crisis of 2008.

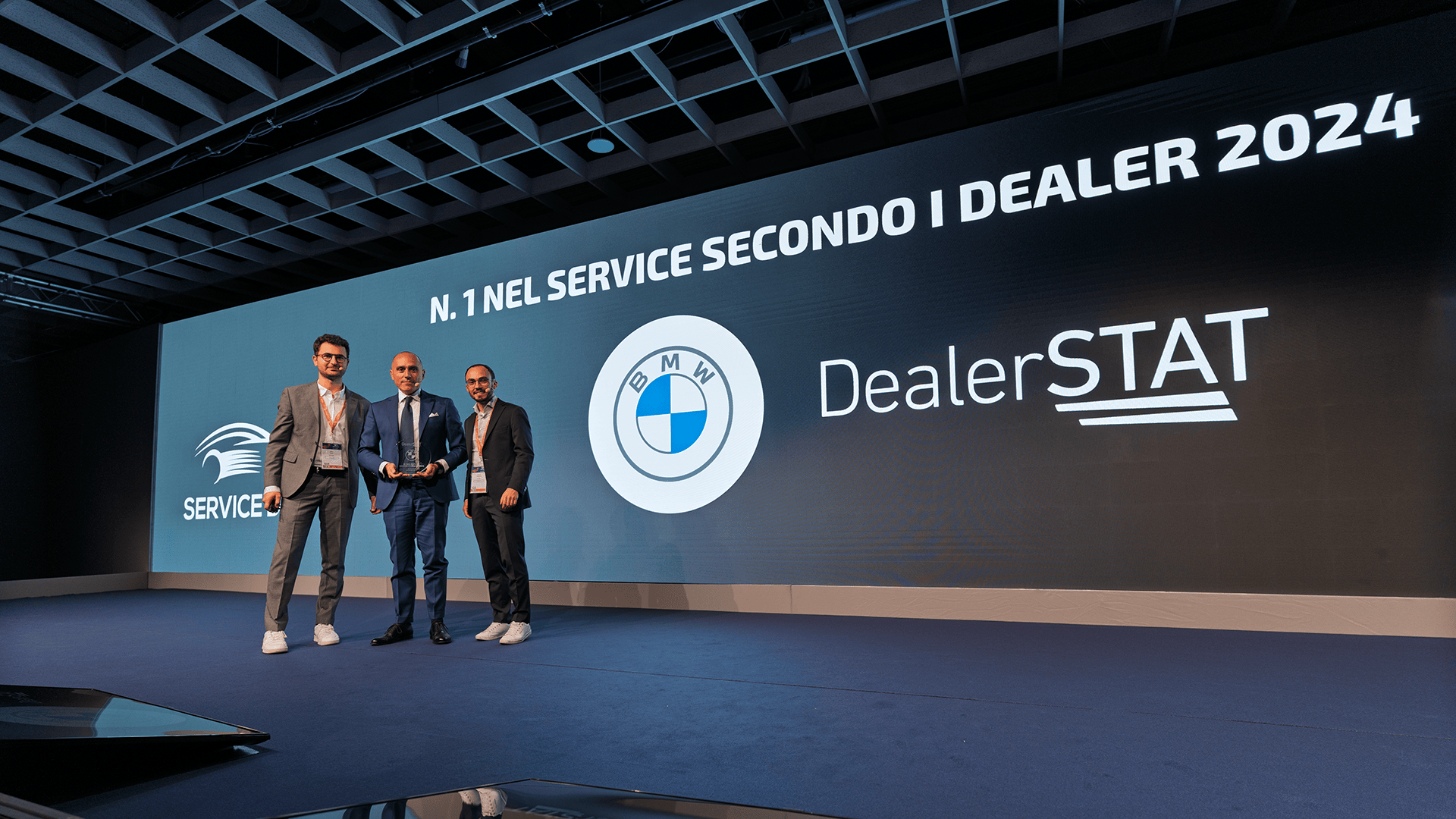

Let’s Dance, No One Excluded. Even Quintegia, a company that has always focused on activities related to the automotive marketing and distribution sector, has been hit by this tsunami on multiple fronts. While our office is closed, and we have swiftly shifted to telecommuting, all areas of our commitment, without exception, have required an evaluation of the impacts and the activation of responses: events (with the rescheduling of the Automotive Dealer Day after the summer), research (with adjustments to some activities to meet the more immediate needs of manufacturers and dealers), the academy (with changes to activity schedules and encouragement to further enhance remote training programs), and services (with a redefinition of the scope of support activities). The situation makes it difficult to predict what will happen in the short term, so it is not advisable to make predictions. It seems wiser to provide some insights as keys to understanding the evolving issues.

The Fragilities of the System. The economic resources that will need to be deployed to try to mitigate the effects of the crisis and its developments are enormous. How will a country like Italy, which has historically relied heavily on taxation related to automobiles and mobility, cope with the collapse of tax revenues associated with prolonged immobilization? Perhaps this crisis will stimulate some rethinking.

Italy also faces a historical difficulty in creating associative bodies capable of providing strength and unified guidance in institutional settings. In times of such intense and sudden crisis, it becomes clear how good an investment it can be for each industry operator to invest resources and actively contribute to strengthening associative entities. It’s never too late to put experience to good use.

The Phases Ahead Toward a “New Normal”. As previously mentioned, the future landscape is unclear. Certainly, for dealership and service companies, there are needs for both resuscitation and rehabilitation, using a human metaphor. As always, every crisis is followed by a more or less extended recovery phase, which in turn leads to a new normalcy. Some observers believe that instead of a few months of paralysis and a subsequent return to previous patterns of life, a longer period of coexistence with pandemic phenomena may occur, which could involve phases of “stop and go” where peaks in the impact on the healthcare system lead to phases of restriction and phases of relaxation of travel and social interactions, impacting both consumption and business activities.

In addition to some consumption atrophy (market data from China suggests that even as we exit the crisis, sales remain unsatisfactory), the new normalcy is likely to be characterized by a changed landscape of consumer sentiments, value dynamics, and aspirations regarding certain aspects (e.g., environmental impact) or market segments (think, for example, of premium and luxury).

The new value frameworks are likely to deeply affect the relationship between citizens and businesses, as well as the very purpose of businesses. These are themes that are in line with the “RESET” initiative related to social responsibility, the sense of enterprise, and the relationship with the local community that Quintegia and Findomestic Bank launched at the end of 2019.

Forced Innovation. Automotive distribution operators have been involved in a multi-level innovation process for several years. These overlapping plans have guided the development of the Automotive Dealer Day program in the past and even more so in 2020: digital transformation (reviewing the company’s structure and processes in an increasingly digitalized context), mobility transformation (evolving the business model from a predominant focus on products to a predominant focus on services), human transformation (remixing the set of skills in the knowledge work era, aligning individual attitudes with organizational goals, and bringing businesses and people closer). Recent events push innovation to encompass even more ambitious fronts, as highlighted by Jay Rao, a professor at Babson College in Boston: the realization that innovation is a process that involves risk management, navigating uncertainty, and exploring ambiguity. This changes the way we experience business.

Asymmetric Impact. We can expect that this crisis will lead to a sector that is profoundly changed asymmetrically, meaning different consequences for different operators. In the 1970s, the oil shock and the sudden increase in gasoline costs caused small Japanese cars to start displacing the dominance of domestic manufacturers in the US, who had always focused on large vehicles with fuel-hungry engines. This event marked the beginning of a new order that changed the world forever, with new power dynamics between local and Asian brands, which eventually went on to conquer the world with a lean production approach. In summary, we can hypothesize that this crisis in the automotive distribution sector will lead to three main consequences. First: a significant selection among operators, favoring the strongest and most efficient ones. In essence, we will have fewer dealerships, accelerating a trend that was already underway. Second: a transformation in the way dealerships operate, with more experiments in new organizational and contractual forms of retail linked to different economic aspects (e.g., smaller facilities, remote work, agency formats). In essence, we will have different dealerships or retail operators than before. Third: the creation of innovative partnerships that cut across different merchandise categories, with surprising approaches and synergies. In essence, we will have synergistic constellations with operators

In the Presence of a New World. Undoubtedly, in this phase of paralysis and isolation, the need for dialogue, a shared search for response methods, and experimentation with innovative practices is growing. Quintegia will also strive in every possible way to do its part, aware that it unites all the actors in the supply chain, namely dealers, manufacturers, and service companies: history teaches us that brands that act effectively during a crisis become significantly stronger afterward. As Andrea Fontana reminds us in his recent and prophetic book ‘Dancing with the Apocalypse,’ catastrophic changes that have occurred throughout history do not lead to an ‘end of the world,’ but rather to the ‘end of a world,’ with the generation of new social, entrepreneurial, and vital habitats. All of us, who work in various ways in the automotive sector, were gearing up to collectively give ourselves the warmest welcome possible into the era of new mobility. Now, let’s give ourselves the inevitable welcome to the new times and the mission they entail for each of us, which is to take innovation to the next level.